Enterprise Risk Management (ERM) is a comprehensive framework that helps businesses like yours identify, assess, and manage risks across all areas, including financial, operational, strategic, and compliance risks. Unlike traditional risk management, which often focuses on specific aspects, ERM offers a holistic approach, ensuring that every potential risk is addressed. This integrated strategy is crucial for maintaining your business continuity, protecting assets, and driving long-term success.

A robust ERM program is built on several key components that work together to form a strong risk management framework:

Risk Identification: The process begins with identifying potential risks that could affect your organisation, including both internal and external threats such as market changes, regulatory shifts, and cybersecurity risks.

Risk Assessment: After identifying risks, it’s important to assess them in terms of their likelihood and potential impact, allowing you to prioritise risks and allocate resources accordingly.

Risk Mitigation: Once risks are assessed, strategies to mitigate them must be developed. This might involve implementing new policies, adopting advanced technologies, or transferring risks through insurance.

Risk Monitoring: Continuous monitoring ensures that your risk management strategies remain effective. Regular reviews and updates to the ERM framework allow you to adapt to emerging threats and seize new opportunities.

By integrating these components, your business can establish a resilient risk management strategy that not only safeguards against potential threats but also supports future growth and stability.

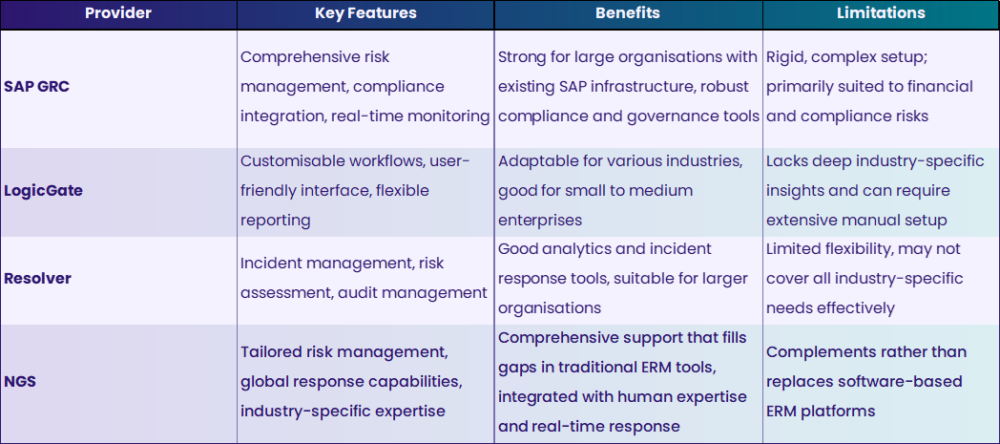

When considering Enterprise Risk Management (ERM) solutions, it’s important to look at both software platforms and specialised service providers. Traditional ERM software solutions like SAP GRC, LogicGate, and Resolver offer comprehensive frameworks for managing various business risks. However, these platforms often focus heavily on compliance, data management, and internal controls, sometimes missing the human element and specialised support that companies like NGS provide.

Key Takeaway: While traditional ERM platforms like SAP GRC, LogicGate, and Resolver excel in data management, compliance, and internal risk controls, they often fall short in providing the specialised, on-the-ground support that NGS offers. NGS fills these gaps with tailored solutions that include real-time tracking, crisis response, and expert consultancy, ensuring that risks are managed holistically.

NGS is not a direct competitor to traditional ERM software platforms; instead, we complement these tools by providing specialised services that software alone cannot deliver. Here’s how NGS fits into your overall risk management strategy:

Real-Time Crisis Response: While SAP GRC and similar platforms can identify and monitor risks, they typically lack the ability to provide immediate, on-the-ground crisis response. NGS offers global response capabilities, including security, medical assistance, and emergency evacuations, ensuring your organisation is supported when and where it matters most.

Human Expertise and Consultancy: Software platforms are excellent for automating processes and analysing data, but they cannot replace the value of human expertise. NGS provides expert consultancy and industry-specific insights, helping you navigate complex risk environments that require more than just data-driven decisions.

Industry-Specific Support: Traditional ERM platforms may offer broad risk management capabilities, but they often lack the nuanced understanding required for specific industries. NGS tailors its services to meet the unique challenges of sectors like finance, healthcare, and manufacturing, ensuring that your risk management strategy is both comprehensive and relevant.

Flexible, Customisable Solutions: NGS offers flexible pricing and customisable service blocks that can integrate seamlessly with your existing tools. Whether you need additional support for travel risk management, crisis response, or specialised training, NGS can provide the specific services you need without overhauling your entire risk management framework.

Key Takeaway: NGS should be considered a vital part of your overall ERM strategy, offering the specialised services and human expertise that traditional ERM platforms can’t provide. By integrating NGS into your risk management plan, you ensure that all aspects of risk—both strategic and operational—are effectively managed.

Implementing an effective Enterprise Risk Management (ERM) strategy requires a clear, structured approach. Here’s how to get started:

Initial Risk Assessment: Start by identifying potential risks across all areas of your business. Engage key stakeholders to ensure a thorough assessment of these risks.

Develop a Risk Management Framework: Create a framework that outlines the process for identifying, assessing, mitigating, and monitoring risks. This framework should fit your organisation’s specific needs and industry.

Engage Stakeholders: Gain buy-in from all levels of the organisation. Communicate the importance of risk management and involve stakeholders in the process to build a risk-aware culture.

Integrate ERM into Company Culture: Embed ERM into daily operations by making it a part of your company’s culture. Regular training, clear communication, and considering risk management in decision-making processes are key.

Ongoing Monitoring and Review: Continuously monitor the effectiveness of your ERM strategy. Regularly review and update your practices to adapt to new threats and changes in the business environment.

Following these steps will help you build a strong ERM strategy that protects your organisation and supports growth.

When implementing ERM, businesses often encounter challenges. Here’s how to tackle them:

Resource Constraints: Many organisations have limited time and budget. Prioritise the most critical risks first, and consider using external expertise to supplement your internal team.

Resistance to Change: Employees may resist new processes. Overcome this by clearly communicating ERM’s benefits, offering training, and showing how it protects both the organisation and its employees.

Lack of Engagement: Without active participation, ERM can fail. Encourage leadership to champion ERM efforts and ensure that risk management is a priority across the organisation.

By addressing these challenges head-on, you can implement a successful ERM strategy and effectively manage risks within your organisation.

AI and automation are transforming the future of ERM, offering advanced risk prediction and more efficient responses. AI-powered tools can analyse vast amounts of data to identify patterns and predict potential risks before they occur. This predictive capability allows businesses to take proactive measures, reducing the likelihood of disruptions.

Automation also plays a significant role by streamlining repetitive tasks, such as data entry and report generation, freeing up time for risk managers to focus on strategic decision-making. Emerging technologies like machine learning and predictive analytics are set to shape the future of risk management, providing businesses with deeper insights and more agile responses to evolving risks.

As these technologies continue to advance, they will enable organisations to manage risks more effectively, ensuring greater resilience and continuity in an increasingly complex business environment.

To measure the effectiveness of your Enterprise Risk Management (ERM) program, it’s essential to monitor specific Key Performance Indicators (KPIs). These KPIs provide insights into how well your ERM strategy is functioning and where improvements may be needed.

Tracking these KPIs regularly allows you to analyse trends, identify areas for improvement, and ensure that your ERM program continues to protect your organisation effectively.

Continuous improvement is crucial for maintaining an effective ERM strategy. Regularly reviewing and updating your ERM processes helps you stay ahead of emerging risks and adapt to changes in the business environment.

Gather feedback from stakeholders at all levels to identify gaps in your ERM strategy. Use surveys, interviews, and data analysis to gain insights.

Base your ERM updates on data collected from your KPIs and feedback. This ensures that changes are both relevant and effective.

Schedule periodic reviews of your ERM strategy to evaluate its performance and make necessary adjustments. This proactive approach helps you maintain a resilient risk management framework.

By focusing on continuous improvement, you ensure that your ERM program evolves with your business, offering robust protection against both current and future risks.

Choosing the right Enterprise Risk Management (ERM) provider is crucial for your organisation’s long-term success. Here are some expert tips on what to consider:

Implementing ERM is not without challenges. Here’s how to avoid common mistakes:

Underestimating Resource Needs: Many businesses fail to allocate sufficient resources for ERM implementation. Avoid this by planning for the time, budget, and personnel required to get your ERM strategy up and running.

Neglecting Stakeholder Engagement: ERM requires buy-in from all levels of the organisation. Failing to engage key stakeholders can lead to resistance and poor adoption. To counter this, involve stakeholders early and communicate the benefits of ERM clearly.

Overcomplicating the Solution: Some organisations try to implement overly complex ERM systems that are difficult to manage. Keep your approach straightforward and focus on the most critical risks first. Simplicity in design often leads to better execution.

Ignoring Continuous Improvement: ERM is not a one-time project. Failing to review and update your ERM strategy regularly can leave your organisation vulnerable to emerging risks. Make continuous improvement a core part of your ERM plan.

By carefully selecting your ERM partner and avoiding these common pitfalls, you can ensure that your risk management program is both effective and sustainable.

Discover how NGS can complement and improve your existing Enterprise Risk Management (ERM) solutions by booking a personalised demo. In this session, you’ll see how our services fill the gaps that traditional ERM software might leave uncovered. Learn how our real-time tracking, global response capabilities, and expert consultancy can enhance your overall risk management strategy, ensuring that your business is fully protected.

Integrating the right ERM solutions is vital, but ensuring they are fully comprehensive is where NGS comes in. By complementing your existing tools with our tailored services, you can cover all aspects of risk management, from on-the-ground response to expert consultancy.